You can make a difference! Your donation helps provide life-changing programs to children, youth, and families struggling with mental health challenges and individuals living with autism in Brant, Halton, and Hamilton. Please give the gift of hope by making a tax-deductible donation to Woodview Mental Health and Autism Services today. Together, we can strengthen lives!

You Can Give the Gift of Hope

Other Ways to Donate

Cheque

Send a cheque made out to Woodview Mental Health and Autism Services and mail to:

69 Flatt Road, Burlington ON L7P 0T3

Please indicate in the memo what program or region you would like the donation to go to.

Phone

You can call us at 905-689-4727 ext. 110 and we’ll take your credit card number over the phone.

Leave a Gift in Your Will

By leaving a gift to Woodview in your Will you can make a bigger contribution than you ever thought possible to support child and youth mental health and/or individuals living with autism in our community. We’ve been serving the communities of Brant, Halton, and Hamilton for 60 years. You can help ensure that those in need are served for years to come.

No matter the size of the gift, leaving a legacy can make an impact for generations to come in the cause area you care about. You can still support your loved ones if you choose to leave a charitable bequest.

Jen Brown Scholarship

Your gift can help students achieve their dreams of post-secondary education. Woodview established the Jen Brown Memorial Scholarship Fund to honour the memory of Jen Brown, a Woodview staff member, who passed away in May 2020.

Donations to the Jen Brown Memorial Scholarship are awarded annually to a current or previous participant in one of the Woodview Mental Health and Autism Services programs to help with the cost of post-secondary education.

The Jen Brown Memorial Scholarship Fund is administered by the Community Education Awards Hub at the Oakville Community Foundation. You will be taken to the Oakville Community Foundation website to complete this donation.

Donate a Vehicle

Woodview is partnering with Donate a Car Canada to accept your car donation! You will be provided free towing, or you can drop off your vehicle to maximize your donation. When you donate your car, truck, RV, boat, or motorcycle to Woodview Mental Health and Autism Services through Donate A Car Canada, it will either be recycled or re-sold (depending on its condition, age and location). Donate a Car Canada will look after all the details for you to make it easy for Woodview to benefit. You will receive a tax receipt after your car donation has been processed!

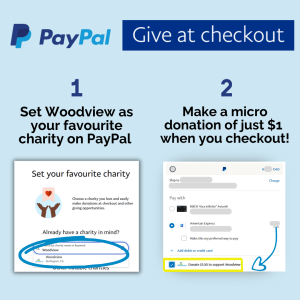

Give at Checkout

Donating to Woodview is now as simple as shopping online! With PayPal’s ‘Give at Checkout,’ you can effortlessly support Woodview by selecting us as your favourite charity in your PayPal account and donating $1 at checkout. Every purchase becomes a chance to make a difference!

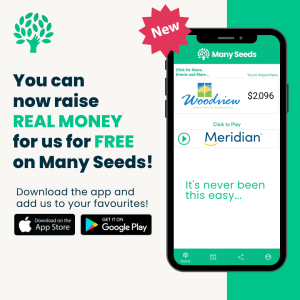

Many Seeds App

You can now raise money for Woodview with the Many Seeds App – for free. Watch a daily 15-second ad on the Many Seeps app and over time the ‘many seeds’ add up! Download the App today and add Woodview to your favourites.

Tax Receipt Policy

At Woodview, we’re grateful for every donation that helps us support children and youth facing mental health challenges and autistic individuals. As a registered charity under the Income Tax Act (Charitable Business Registration number: BN 119303923RR0001), we offer official charitable donation receipts. These receipts can be used to claim a non-refundable tax credit on your income tax return, making your generosity go even further.

Online Donations: Donations made directly through our website are automatically receipted in the donor’s name. You’ll receive your tax receipt via email shortly after making your donation, so please ensure your email address is entered correctly.

Donations by Cheque, Cash, or E-Transfer: These donations are also eligible for a charitable tax receipt, in accordance with the Canada Revenue Agency’s gift acceptance policies. Please provide your full name and mailing address with your donation to ensure you receive your tax receipt.

For any questions or if you need assistance with your donation, please contact:

Michelle Bake-Murphy

Woodview Communications & Fundraising

905-689-4727 ext. 141

Email Me

Your support makes a world of difference, and we thank you for helping us make a positive impact in the lives of those we serve.